NBP Ghar Finance Scheme 2025

Owning a home (“apna ghar”) is the dream of many Pakistanis. But because of rise, rising building prices, and limited financial resources, many find it problematic to achieve this dream. To address this, NBP (National Bank of Pakistan) offers housing finance under its Mera Pakistan Mera Ghar / NBP Saibaan / Home Finance / “Ghar Finance” offerings. This scheme helps folks purchase, build, expand, or renovate homes finished bank backing with backed rates and flexible payment terms.

After this intro, here is a quick-info table summarizing key features:

| Program / Scheme Name | Start Date | End Date / Duration | Maximum Loan Amount | Subsidy / Special Rate | Application Method |

|---|---|---|---|---|---|

| Mera Pakistan Mera Ghar (NBP) | Ongoing | Until further notice | Up to approx. PKR 10 million (varies) | Mark-up subsidized by Govt under “Roshan Ghar” or related housing schemes | Online (where available) / In-branch |

| NBP Saibaan Home Finance | Ongoing | Up to 20 years typical | Up to PKR 35 million (depends) | Conventional / Islamic options; competitive rates | Submit form at NBP branch / Saibaan desk |

Note: The “start date” is for when the arrangement began; there is no fixed “end date” — arrangements run until further notice. The “maximum loan quantities” and subsidy terms depend happening administration policy, category (low-income, middle, etc.), and specific product.

What Exactly Is NBP Ghar Finance (Mera Pakistan Mera Ghar / Home Finance)?

This NBP Ghar Finance Scheme 2025 allows people to:

- Buy an already built house, flat, or apartment

- Purchase land (plot) and build on it

- Extend, repair, or renovate an existing home

- Finance via conventional interest or Islamic (Shariah-compliant) models

- Avail government subsidy (for eligible low-income cases) under national housing programs

According to NBP’s official site, Mera Pakistan Mera Ghar finances terrestrial acquisition, flat/house acquisition, and postponement/expansion/face-lift. Also, NBP has “Saibaan Home Finance” products cover purchase, construction, home development, land + construction, and balance transfer.

At present, the “Mera Pakistan Mera Ghar” scheme appears to be provisionally postponed (as per NBP’s website) but may recommence. But NBP’s home backing via Saibaan is active.

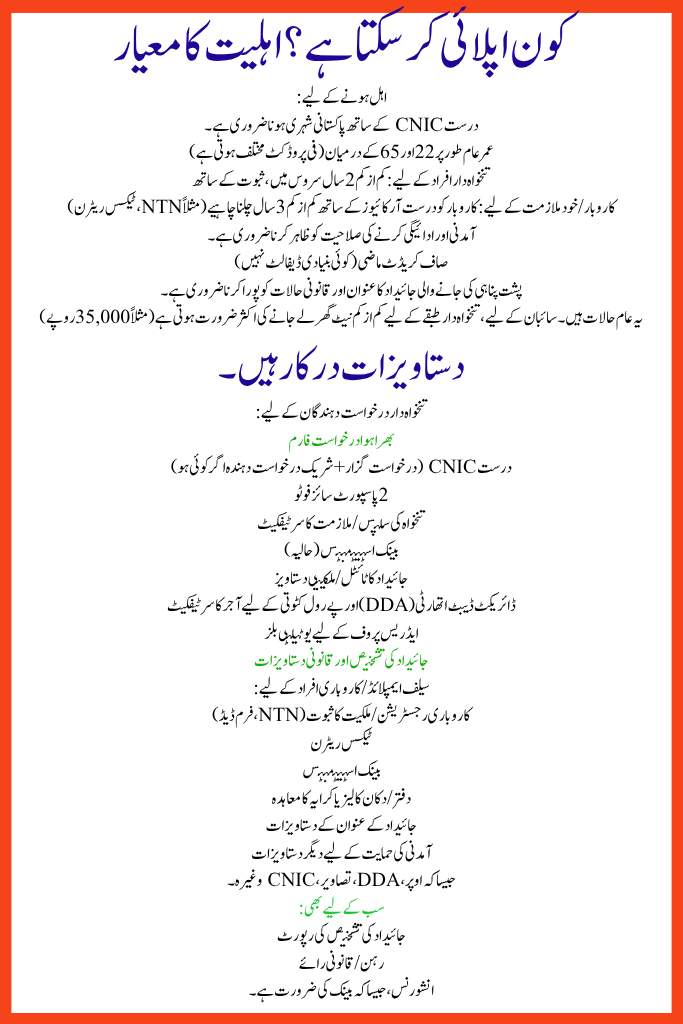

Who Can Apply? Eligibility Criteria

To be eligible NBP Ghar Finance Scheme 2025:

- Must be a Pakistani citizen with valid CNIC

- Age typically between 22 and 65 ages (varies per product)

- For salaried persons: at least 2 years in service, with proof

- For business / self-employed: business should run least 3 years, with valid archives (e.g. NTN, tax returns)

- Must show income and ability to repay

- Clean credit past (no main defaults)

- The property to be backed must satisfy title and legal circumstances

These are common conditions. For Saibaan, minimum net take home for salaried class is often required (e.g. Rs 35,000)

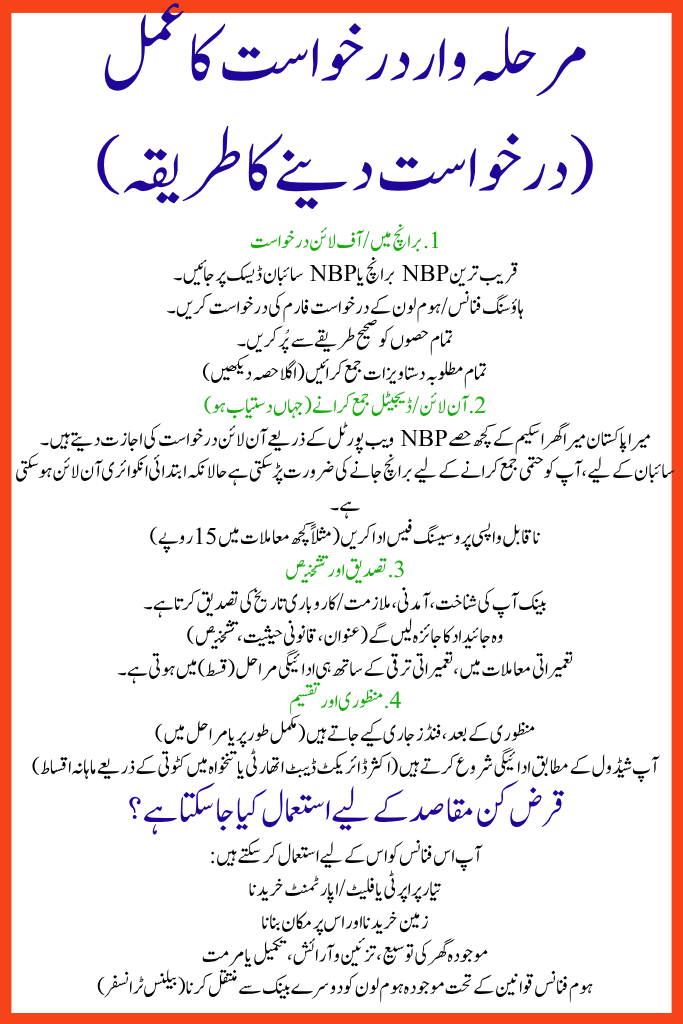

What Purposes Can the Loan Be Used For?

You can use this NBP Ghar Finance Scheme 2025 finance for:

- Buying a ready property or flat/apartment

- Purchasing land and constructing a house on it

- Extending, renovating, finishing, or repairing an existing house

- Transferring an existing home loan from another bank (balance transfer) under home finance rules

Loan Amount, Tenure & Markup / Interest

- Maximum financing under Saibaan can go up to PKR 35 million in some categories.

- Tenure (repayment period) ranges from 3 years to 20 years in home purchase / construction segments.

- Banks typically follow guidelines: housing finance not more than 20 years.

- The mark-up / interest rate is a competitive rate (floating or fixed for some period).

- Example: For NBP Roshan Ghar Solar Finance (related product), the fixed markup for 2 years is 12.49%.

- Under the government’s low-cost housing/“subsidy” schemes, eligible low-income groups may get subsidized rates or special support.

Important: The exact rate and terms depend on category, credit, project, and whether subsidy applies.

Step-by-Step Application Process (How to Apply)

1. In-Branch / Offline Application

- Visit the nearest NBP branch or NBP Saibaan desk

- Request the housing finance / home loan application form

- Fill out all sections correctly

- Submit all required documents (see next section)

2. Online / Digital Submission (Where Available)

- Some parts of Mera Pakistan Mera Ghar scheme allow online application via NBP web portal.

- For Saibaan, you may need to visit branch for final submission though initial inquiry might be online

- Pay non-refundable processing fee (e.g. Rs. 15 in some cases)

3. Verification & Appraisal

- Bank verifies your identity, income, employment/business history

- They will evaluate the property (title, legal status, valuation)

- In construction cases, disbursement happens in phases (tranches) as construction progresses

4. Approval & Disbursement

- Once approved, funds are released (in full or in phases)

- You start repayment as per schedule (often monthly installments via Direct Debit Authority or salary deduction)

Documents Required

For salaried applicants:

- Filled application form

- Valid CNIC (applicant + co-applicant if any)

- 2 passport size photos

- Salary slips / employment certificate

- Bank statements (recent)

- Title / ownership document of the property

- Direct Debit Authority (DDA) & employer certificate for payroll deduction

- Utility bills for address proof

- Property valuation & legal documents

For self-employed / business persons:

- Business registration / ownership proof (NTN, firm deed)

- Tax returns

- Bank statements

- Office/shop lease or rent agreement

- Title documents of property

- Other documents to support income

- As above, DDA, photos, CNIC etc.

Also for all:

- Property appraisal report

- Mortgage / legal opinion

- Insurance, as required by bank

Advantages (Benefits) of NBP Ghar Finance Scheme

- Nationwide reach: NBP Ghar Finance Scheme 2025 has many branches, so even people in smaller cities can access it

- Flexible tenures: up to 20 years or more, depending on product

- Various housing options covered (purchase, construction, renovation)

- Option for balance transfer (move existing home loan)

- Backed by government / state bank housing incentives / subsidies in many cases

- Safe & reliable: NBP is a government-owned bank with regulatory oversight

- Possibility of fixed rate periods (for some parts of the loan)

- Islamic & conventional options may be available (depending on product)

Things to Watch / Considerations

- The scheme Mera Pakistan Mera Ghar is currently marked “temporarily suspended” on NBP website. Always confirm with nearest branch or via NBP website for availability.

- Interest / markup rates can change depending on macroeconomic factors and bank policy

- Eligibility and documentation must be thorough; weak documentation can lead to rejection

- Monitoring of construction (if building) is required — delays can affect disbursement

- The property title must be clean; any legal dispute can block approval

- Early repayment: some products may allow it without penalty (verify with bank)

- Co-applicants are allowed in many cases (to strengthen income)

Conclusion

The NBP Ghar Finance / Mera Pakistan Mera Ghar / Saibaan Home Finance arrangement is a influential tool for ordinary Pakistani citizens who dream of owning, building, or improving a home. With competitive rates, flexible repayment options, and administration support for eligible collections, it bridges the gap between ambition and affordability.

Before applying, continuously contact your adjacent NBP branch or check the latest rank on the authorized NBP website to verify that the arrangement is active, the terms, and any vicissitudes. With a clear plan, proper certification, and suitability, this scheme can turn your “ghar ka sapna” into reality.

Related Posts