How to Get Interest‑Free Loan

Looking for a free loan from Akhuat to uplift your business or cover personal needs without paying interest? Pakistan’s Akhuwat Foundation offers interest‑free loans (Qard‑e‑Hasna) designed to support low‑income families, entrepreneurs, students and more. In this guide, you’ll find all the up‑to‑date steps, requirements, tips and official info from the Akhuwat official website

Also Read ; Check your Application Status for CM E-Taxi Scheme

Key Facts at a Glance

| Feature | Details |

|---|---|

| Loan Type | Interest‑free (Qard‑e‑Hasna) |

| Eligible Individuals | Pakistani citizens with valid CNIC |

| Loan Purposes | Business, education, health, housing, agriculture |

| Collateral Required? | No |

| Main Application Method | Visit nearest official branch |

| Required Documents | CNIC, income proof, references |

| Loan Disbursement | After verification |

| Repayment | Flexible installments, principal only |

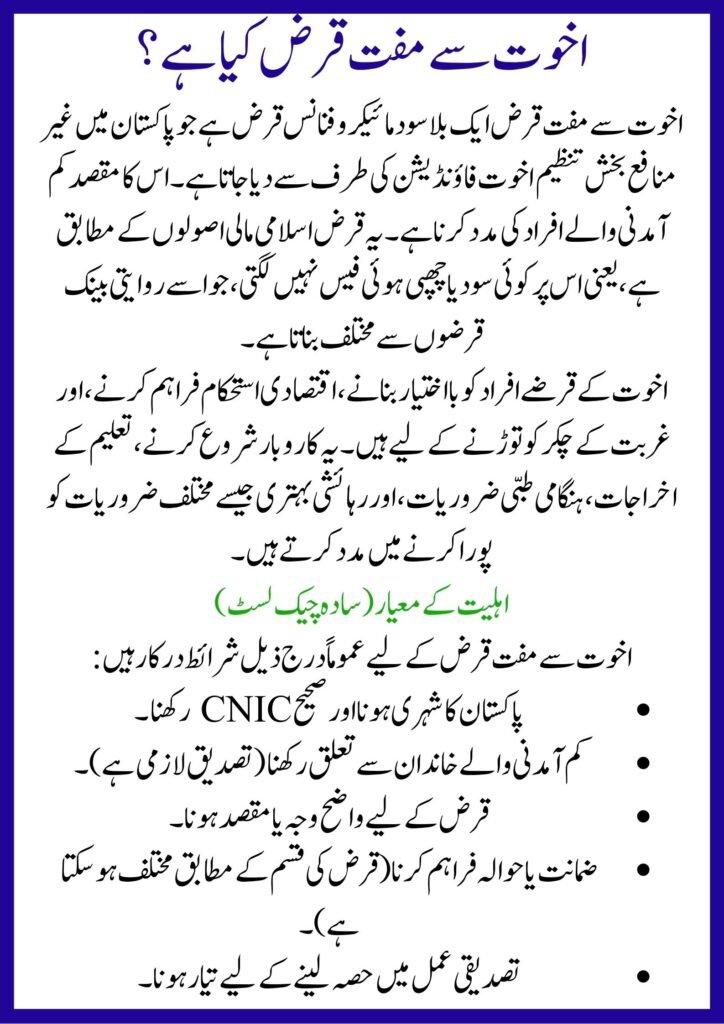

What Is a Free Loan from Akhuat?

A free loan from Akhuat refers to an interest‑free microfinance loan offered by the Akhuwat Foundation, a nonprofit organization in Pakistan that aims to help the underprivileged. These loans follow Islamic financial principles by charging no interest or hidden fees, making them different from traditional bank loans.

Akhuwat loans are intended to empower individuals, provide economic stability, and break the cycle of poverty. They support a wide range of needs business start‑ups, education costs, health emergencies, and housing upgrades.

Eligibility Requirements (Simple Checklist)

To qualify for a free loan from Akhuat, you generally must:

- Be a Pakistani citizen with valid CNIC.

- Belong to a low‑income household (verification required).

- Have a clear reason/purpose for the loan.

- Provide guarantor or references (varies by loan type).

- Be willing to participate in the verification process.

These criteria are based on the official website and top sources online.

1. Documents You Need (Simple Format)

• CNIC copy – National Identity Card.

• Proof of income – salary slips or business income.

• Utility bill – for address confirmation.

• Passport‑size photos – recent photos.

• Reference/Guarantor details – for credibility.

These documents help verify your eligibility before approval.

2. Step‑by‑Step Process to Apply

Follow this guide to apply for a free loan from Akhuat:

- Find your nearest Akhuwat branch using the official site.

- Visit in person with your documents.

- Fill out the official loan application form.

- Submit all required documents and references.

- Attend any interview or verification check by the team.

- Wait for approval communication from Akhuwat.

- Receive your loan once approved.

This sequence is confirmed by the official info and multiple trusted sources.

3. Types of Interest‑Free Loans Available

Here are the most common categories offered under the Akhuwat loan program:

- Micro‑Business Loans – for small entrepreneurs.

- Education Loans – to pay tuition and school expenses.

- Health Loans – for urgent medical needs.

- Housing Loans – for building or repairing homes.

- Agriculture Loans – to support farmers with inputs.

Each category addresses different financial burdens with no interest.

4. Tips for a Successful Loan Application

• Ensure all documents are legible and valid.

• Provide clear financial needs and purpose.

• Have at least two references or guarantors ready.

• Be punctual and polite during verification.

• Ask questions if any part of the process is unclear.

Being prepared increases your chances of approval.

Helpline & Contact Information

For help, support, or location details, you can contact Akhuwat directly:

Official Helpline: Call Akhuwat Foundation for assistance and latest updates. (Use the helpline data from the official site or verified listings double‑check on akhuwat.org.pk).

Official Website: Visit Akhuwat’s genuine site to find branches and the latest policies. (Always verify the URL to avoid scams.)

Important: There are fake websites and scam numbers claiming to offer Akhuwat loans. Always verify the official link before sharing personal information.

Conclusion

Getting a free loan from Akhuat can be life‑changing if you’re eligible and prepared. Akhuwat’s interest‑free loan scheme focuses on helping people with dignity and transparency. This article shared information based on the official website and multiple trusted Google sources, so you can confidently follow the steps. Remember to prepare your documents, visit an official branch, and avoid unofficial offers to protect yourself from scams.

Frequently Asked Questions (FAQs)

Do I really not pay any interest on Akhuwat loans?

Yes, Akhuwat loans are interest‑free (Qard‑e‑Hasna), and borrowers only repay the principal amount.

Can I apply for the loan online?

Official policy emphasizes in‑person applications at verified branches. Be cautious of websites claiming online forms.

What if I don’t have a guarantor?

Some loans may require references; check with your local branch for flexible options.

How long does approval take?

Verification and approval usually take a few weeks, depending on your documents and purpose.

Related Posts