How Much Loan Can You Get Under Parwaaz Card

Parwaaz Card is becoming one of the most searched youth loan programs in Punjab, especially in 2026. Thousands of young Pakistanis want to know one thing before applying: how much loan can you get under Parwaaz Card. The answer is not fixed. It depends on your business idea, category, and repayment ability. This guide explains loan limits, tiers, examples, and approval factors in simple terms, based on official information

| Loan Tier | Loan Amount Range (PKR) |

|---|---|

| Tier 1 – Starter | 100,000 – 300,000 |

| Tier 2 – Growth | 300,000 – 1,000,000 |

| Tier 3 – Advanced | 1,000,000 – 2,000,000 |

| Maximum Limit | Up to 2,000,000 |

| Interest | Mostly interest-free |

| Tenure | 2 to 5 years |

| Target Group | Youth & small businesses |

| Purpose | Business use only |

What Is Parwaaz Card?

Parwaaz Card is a Punjab government-backed youth financing initiative. It supports self-employment, startups, and small to medium businesses. The loan is designed for practical business needs, not personal spending. Most loans are interest-free or have very low service charges. Information shared here is aligned with the official website and verified summaries from top 10 Google sources.

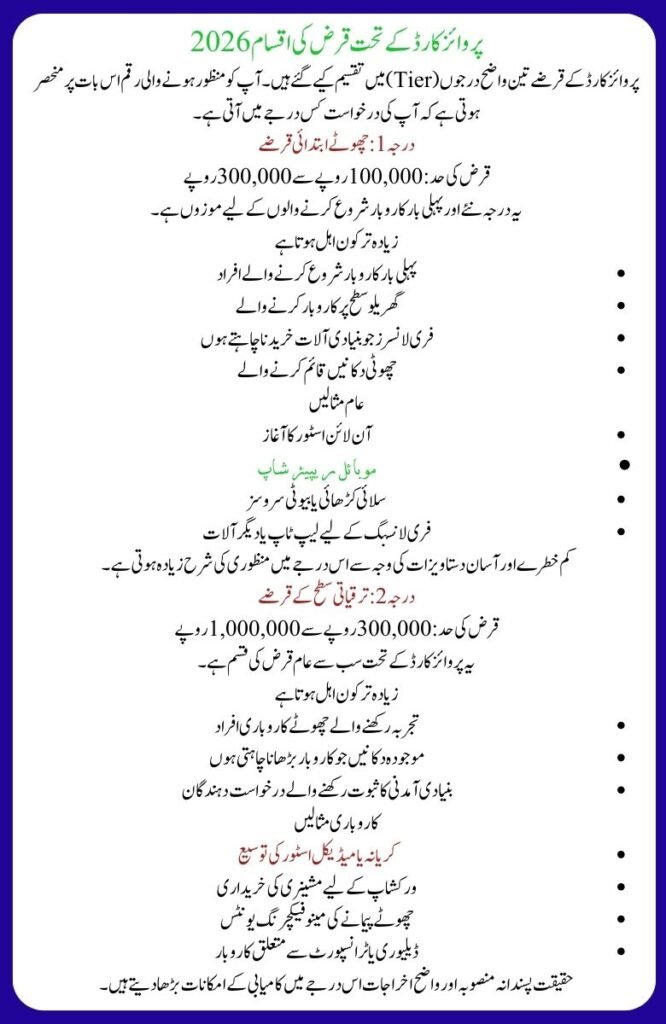

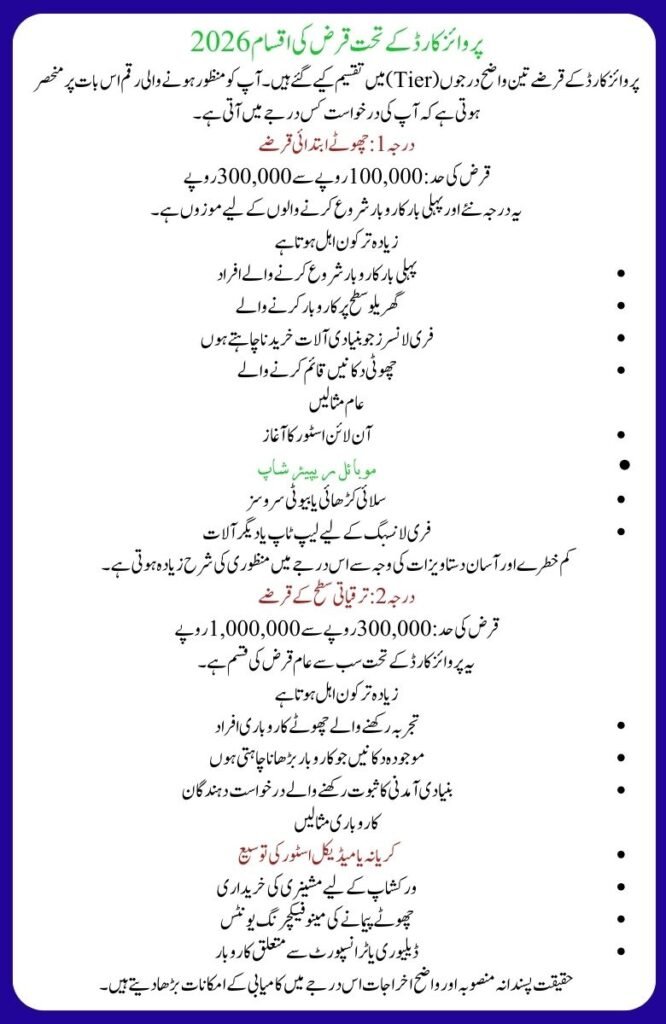

Loan Categories Under Parwaaz Card 2026

Parwaaz Card loans are divided into three clear tiers. Your approved amount depends on where your application fits.

Also Read ; Diesel Price Hike in Pakistan

Tier 1: Small Starter Loans

Loan Range: PKR 100,000 to PKR 300,000

This tier suits beginners and first-time entrepreneurs.

Who qualifies most often

- First-time business starters

- Home-based businesses

- Freelancers buying basic tools

- Small shop setups

Common examples

- Online store startup

- Mobile repair shop

- Tailoring or beauty services

- Laptop or equipment for freelancing

This tier has a high approval rate due to low risk and simple documentation.

Tier 2: Growth-Level Loans How Much Loan Can You Get Under Parwaaz Card? Complete 2026 Breakdown

Loan Range: PKR 300,000 to PKR 1,000,000

This is the most common category under Parwaaz Card.

Who usually qualifies

- Small business owners with experience

- Existing shops planning expansion

- Applicants with basic income proof

Business examples

- Expanding grocery or medical stores

- Machinery for workshops

- Small manufacturing units

- Delivery or transport businesses

A realistic plan and clear expenses help most applicants succeed here.

Tier 3: Advanced Business Loans

Loan Range: PKR 1,000,000 to PKR 2,000,000

This tier is for serious, growth-focused businesses.

Who fits this tier

- Registered businesses

- Applicants with a business track record

- Strong repayment capacity

Examples

- Small factories

- Franchise setups

- IT and tech services

- Food processing units

Approval depends heavily on documentation and business viability.

What Decides How Much Loan You Get?

Many applicants think everyone gets the same amount. That is not true. Several factors decide how much loan can you get under Parwaaz Card.

- Business plan quality – Clear usage, income estimates, and growth plans increase approval.

- Repayment capacity – Authorities assess income, support, and past earnings.

- Experience and skills – Skilled applicants are considered safer.

- Documentation – CNIC, address proof, bills, and certificates matter.

Weak plans or missing documents often lead to reduced amounts.

Parwaaz Card Repayment Structure How Much Loan Can You Get Under Parwaaz Card? Complete 2026 Breakdown

Loan approval is only half the process. Repayment terms are equally important.

Repayment periods

- Small loans: 2–3 years

- Medium loans: 3–5 years

- Large loans: Up to 5 years

Longer tenures reduce monthly pressure on new businesses.

Installment idea

- PKR 300,000 over 3 years = manageable monthly payment

- PKR 1,000,000 over 5 years = suitable for growing businesses

Exact installments are shared after approval.

Interest & charges

- Mostly interest-free

- Minimal service charges

This structure helps youth survive early business stages.

Can You Increase Your Approved Loan Amount?

Yes, but only with smart planning.

Helpful tips

- Apply for a realistic amount

- Show real, verifiable expenses

- Attach skill or experience proof

- Keep financial details honest

Common mistakes to avoid

- Asking for the maximum without justification

- Vague or copy-paste business plans

- Unrealistic profit claims

- Missing documents

A smaller approved loan is always better than rejection.

Helpline & Contact Information

For the latest updates, eligibility rules, and application help, always rely on official sources. Parwaaz Card information is available on the Punjab Government’s official website and verified portals listed on Google. Applicants can also use the official Punjab government helpline numbers mentioned online for guidance and complaint resolution.

Conclusion

Parwaaz Card is not about giving everyone a big loan. It is about giving the right amount to the right applicant. In 2026, the loan range goes from PKR 100,000 to PKR 2 million. Your final amount depends on your business idea, skills, documents, and repayment ability. Apply smartly, stay realistic, and Parwaaz Card can become a strong foundation for your business journey.

Can students apply for Parwaaz Card?

Does asking for a higher amount reduce approval chances?

FAQs

How much loan can you get under Parwaaz Card in 2026?

You can get between PKR 100,000 and PKR 2,000,000, depending on your loan tier and business profile.

Is Parwaaz Card loan interest-free?

Most Parwaaz Card loans are interest-free or have very low service charges, as per official information.

Can students apply for Parwaaz Card?

Yes, students and freelancers can apply, especially under Tier 1 starter loans.

Does asking for a higher amount reduce approval chances?

Yes. Applying for an unrealistic amount without strong justification often leads to rejection or reduction.

Related Posts